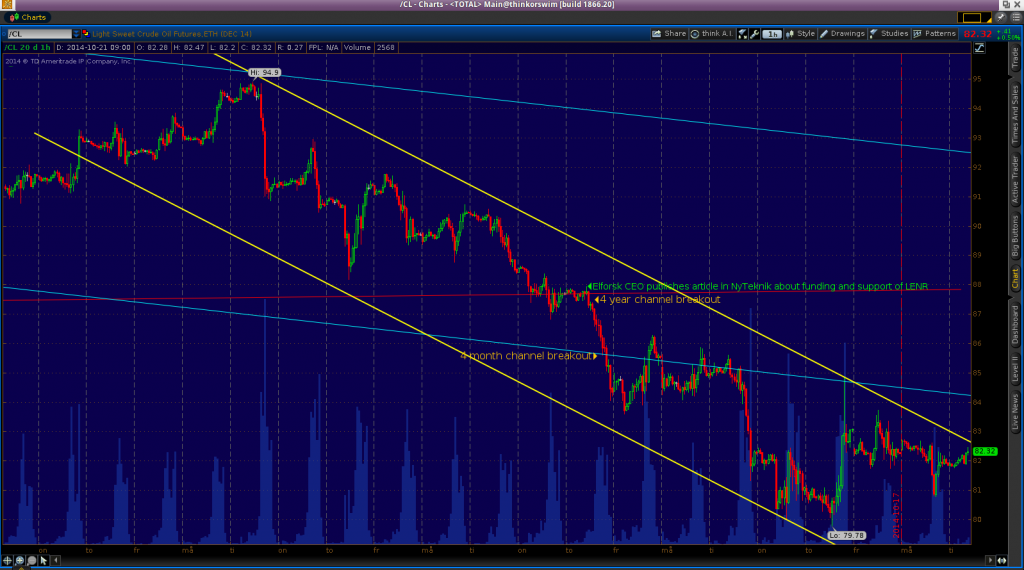

As you might have noticed, I have been asking myself this question for some time. In my article on oilprice.com from march last year I presented the hypothesis that BigOil and BigBanks are already planning for this to happen. This might be so, or not, but fact is that the “swap dealers” are a collective short of 400k-500k contracts on the NYMEX and ICE crude future exchanges. This position was built during 2010-2011 and if we have a look at the chart for the period since, this is what we see.

Since the BigBank/Oil strategy change in 2010, the oilprice has been stabilizing in a 4 year “pennant” aiming for a $90-$100 price range. Until October 9th…

Following previous price moves, staying within the “pennant” a resistance at $88 would have been expected. Instead there was a bearish breakout and the price even accellerated downwards breaking out of the 4 month channel into a new even steeper channel. The hypothesis is that these breakouts might have been initiated by Elforsk, who funded the LENR Lugano Report, when publishing an article Ny Teknik stating that they will keep funding and researching LENR. Looking at the chart below we can see that these breakouts occured within minutes (4year) and hours (4month) after the Elforsk event.

Of course we do not knew yet the significance of these events, but maybe, just maybe it is more than a coincidence.

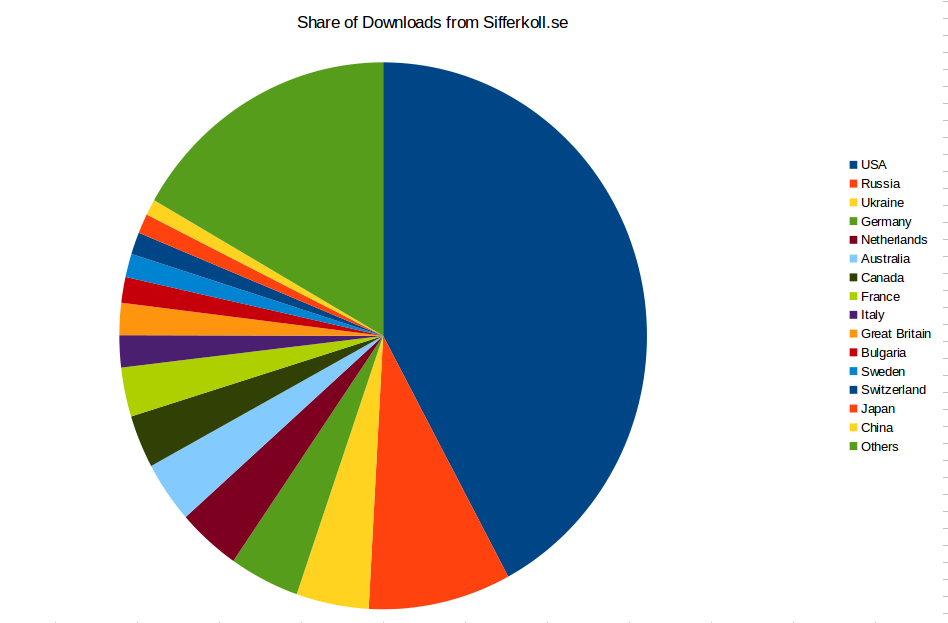

Another piece of interesting information is the list of countries from which the Lugano Report has been downloaded. Summarizing from October 8th the list looks like this.

Both Russia and Ukraine in the top 3…

Ukraine is not in the top 3, the top 3 is USA, Russia and Germany.

This data comes directly from looking up the IP numbers that downloaded the Lugano Report during October 8-20th. No more, no less.

Then your pie chart is wrong…

I see what you mean now. It seems “Germany” and “Others” both got the the same green color, which I didn’t notice … Sorry about that.