Here is an update on the big banks and oilcompanies short position in oil futures. When the price started to move down from the low $60’s end of june, BigOil&Bank initially bought the weakness allthough halting when the price hit ~$50. Even when the price continued to fall all the way below $40 they held on to their short position. Neither did they change their position when the price climbed back to low $50’s again. Instead they started selling again actively from August 25th onward, and now at levels below $50. For whatever reason they obviously believe price is going lower still…

Coincídently this more or less correlates with the day when the Rossi patent was granted.

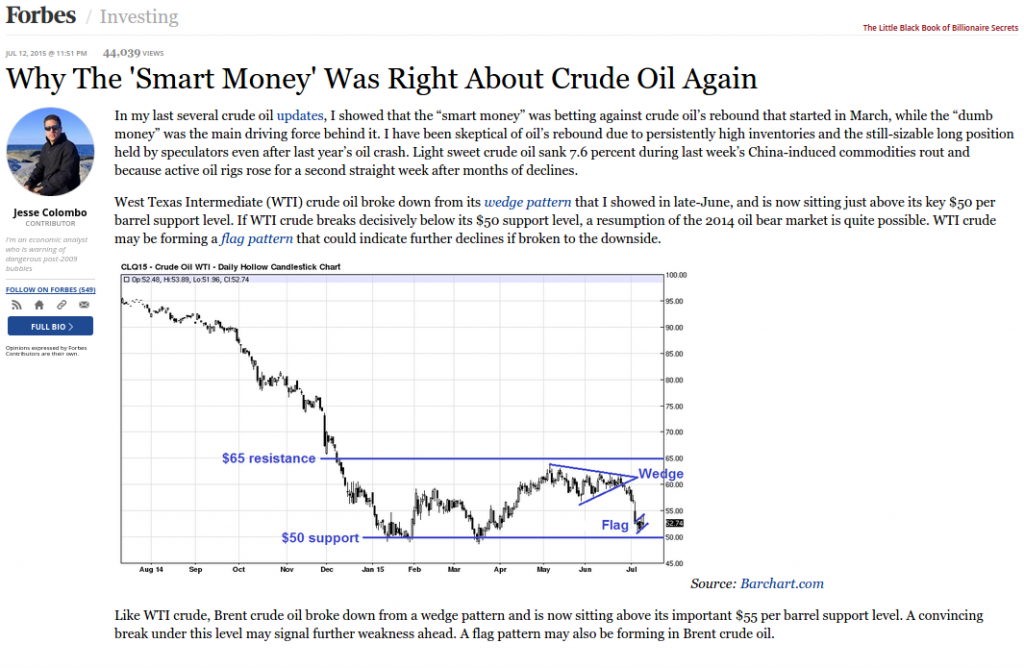

It is also good to know that finally other analysts seems to catch this trend. Here is a link to Forbes.