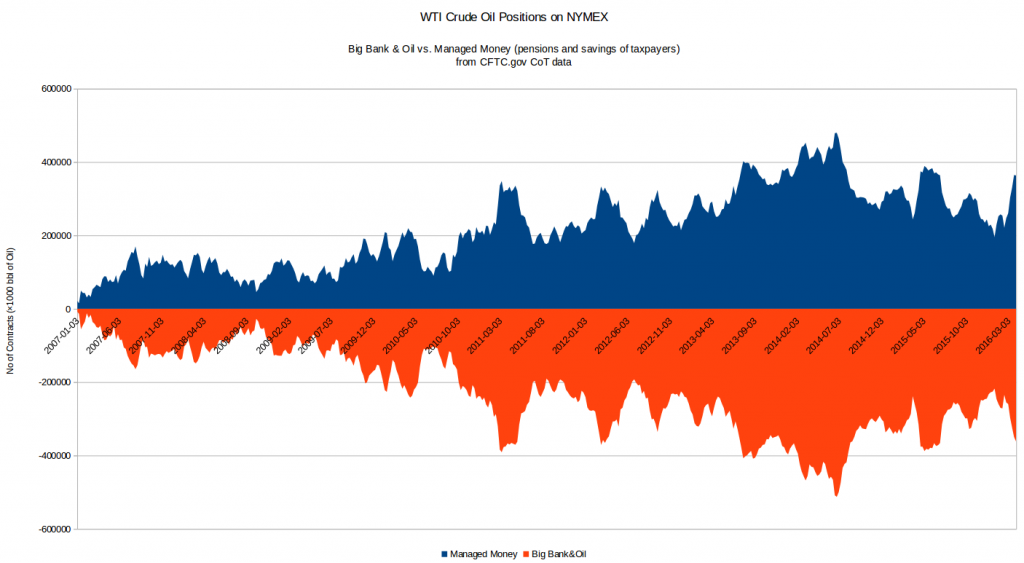

Looking at the CFTC CoT data the Oil selling trend continues for the “Commercials”, ie. the big banks and oil companies. To be clear, this means that they are adding to their already short position. At March 29th the aggregated position was approximately $13.5 billion. They obviously still believe the price us going down.

And the whole time series since 2007. As you can see the The huge Big Bank & Oil short position is mirrored by a long position in managed money (savings and pensions mainly).

A potential avenue that could be explored is that of Low Energy Nuclear Reactions or Lattice Enabled Nanoscale Reactions (LENR). This is a chemical/physical event where anomalous amounts of heat are generated when certain metals absorb hydrogen or deuterium and an external stimulus such as an electric current is directly applied.A potential partner for KSA to partner with is Industrial Heat LLC that was incorporated in 2012 and is based in Raleigh, North Carolina. This firm has already been granted the license to sell and manufacture energy catalysers “E-Cats” in Saudi Arabia. Therefore, I do not think it unreasonable to envisage the Saudis looking for partners to help start laying the groundwork for commercialisation of LENR within the Kingdom and for export overseas.

Pingback: Big Oil & Bank ($GS $JPM $XOM etc.) Selling...

Simply awesome analysis!!

Please keep up the good work!!