Beacuse they are in the process to offload this substantial amount of risk exposure to the taxpayers. Right now.

Of course this is about the distressed debt of the US oil and gas sector.

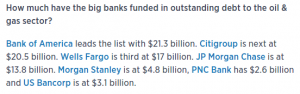

And Goldman Sachs itself adds another $10.6 bn to it, which makes roughly $100 billion.

Compared to this risk the Big Bank short position in oil futures is actually dwarfed, Today the 300 thousand contract short position amounts to $11 billion, A hedge, but not nearly enough.

But as I said. They are acting on it. So far this year about $9 billion has been raised to pay back these debts, As an example JP Morgan are actually raising money for distressed oil companies from the their customers (like pension and saving funds, etc.) to pay back the loans they themselves have given to the oil companies …

This sort of reminds me of what happened before the mortgage bubble burst …

So. Point is. Until the a majority of these “assets” are removed from the Big Bank books, there is reasons to put pressure on everything that might upset the oil price too much. Including #LENR.

Looking at CFTC.GOV data we can also see that The Banks stepped in and started to buy futures when the oil price fell below $30 early february, which then created positive overall energy sentiment both on the high yield bond market and oilprice. At the same time they were offloading their distressed assets to a better price.

Maybe APCO is more important than first realized in this scheme and have turned Industrial Heat into a small brick in the game. Maybe they are vague for 100 billion reasons?

This stuff is not new for APCO. They have tons of experience working for Big Oil and loads of executive experience from Goldman Sachs, etc. Here is one example of many found on google.

Huffington Post about past APCO projects,

Coincidence?

Interesting, but a reality check, please. Is my multiple solar benefit roofing system a threat to Utilities? To be sure, Duke bought Cambar, my closest competition and they have never been heard from again. Perhaps Duke was protecting future profits from Peaking power, and bonuses, yes. Still, disruption isn’t likely to be sexy enough for a snappy headline……….

I’m not that worried about utilities. I think they will do fine since most people will continue to be connected to the grid and even use it more in the future. They will not charge for the actual energy, but for the distribution, etc. It will probably be more decentralized but still a grid. Very few will bail out completely.

The banks however worry about oil and gas exploration companies not beeing able to pay back debts because of lower oilprices. This is what I was writing about.

Not to mention the nuclear industry, whose power generating ‘assets’ will overnight become multi-billion dollar liabilities in terms of decommissioning, reprocessing and disposal.

Pingback: Something Really Bothers Me About the @ApcoWorldwide #LENR Connection! | Sifferkoll®

Solar PV is hitting its stride in total yearly installation. LENR will have many benefits over solar PV in availability, cost and installation. Grid connected LENR generators will begin to offset other typed on central electricity generation. Older inefficient generators will be shut down first and eventually a point will come where the grid will have trouble balancing load, this will cause new installations of LENR to be standalone. The grid is expensive and very unreliable and will eventually be shut down completely at some future point.

Pingback: #LENR #ECAT saga: Weaver goes Schizofrenic about Penon and Reveals a Goldmine of #Cryptodenialism to Study! | Sifferkoll®