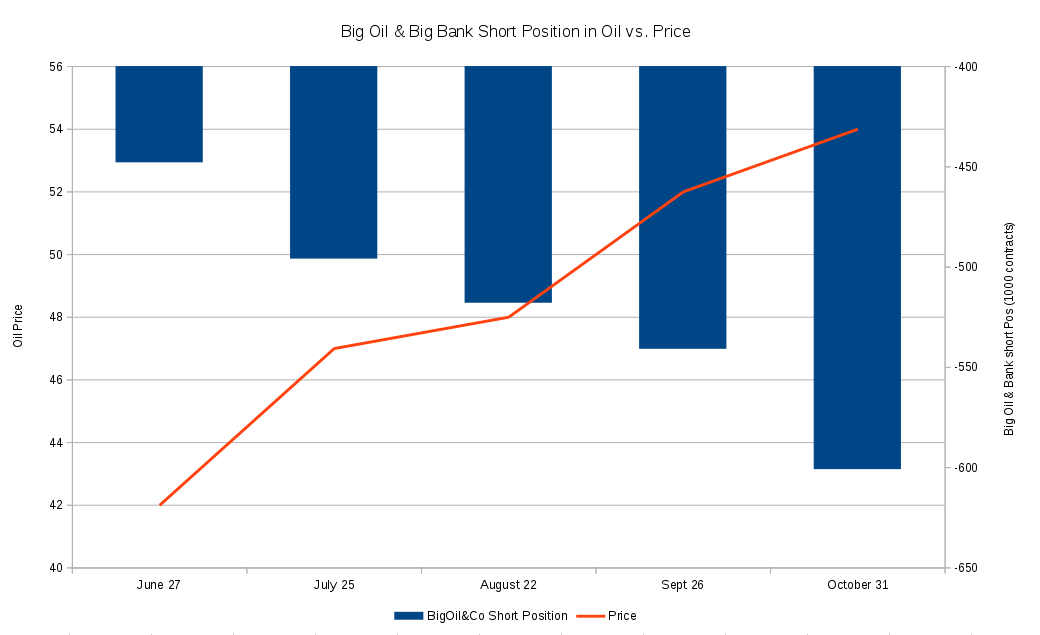

It has been a while since I made a comment on the oil price. Recently there has been a rally from low 40’s in June to ~55 at the moment. So, who is buying? Well, it certainly is not the producers (Big Oil) or the swap dealers (Big Banks). This is what it looks like since June according to the CoT report published weekly by CFTC.GOV

They are consistently taking the short side.

On Oct 31 the producers and swap dealers reported they were 601k contracts short in oil. That is a USD 33 Billion bet on the oil price going DOWN…

Go figure …

Maybe nothing, but then again … Let’s see what happens in a few weeks.

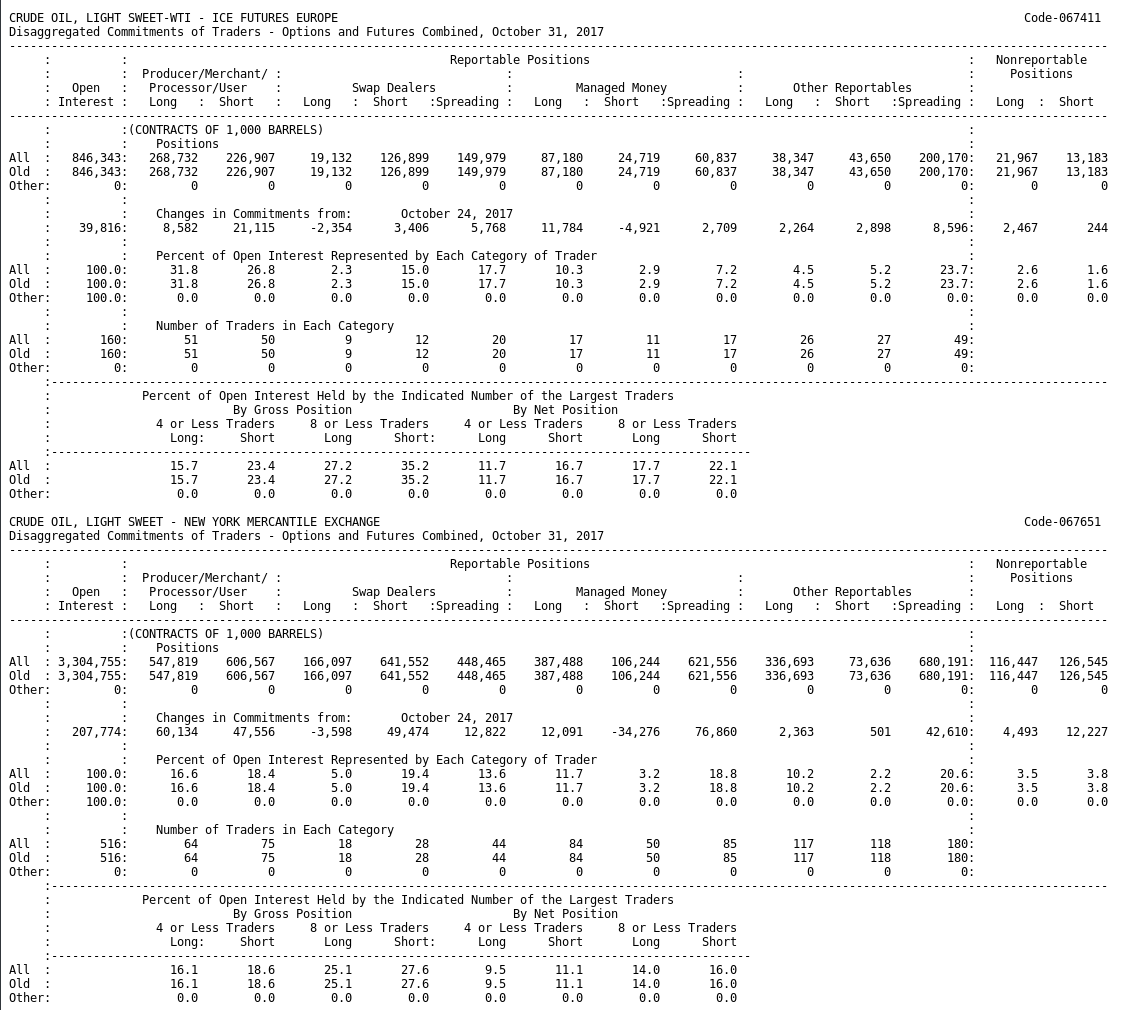

Wow nice info, I learned something new….. Although I see that ‘swaps’ are another of the infamous ‘derivative market’ plays. My limited market knowledge recalls there are time limits to short plays, can you tell any time info from the chart here? ….. Big swaps brings back bad memories. Should be an interesting month !

Yes, but in this case the “Swap dealers” are a name covering the really big players, like Goldman Sachs, JP Morgan, etc. Ie. the Big Banks. The stats I’m quoting are the “normal” crude oil contracts traded on the NYMEX and ICE exchanges where to holdings of the different players are reported weekly to CFTC.